Stanford Payroll Calendar 2026 - This page provides important payroll information for new and current employees, including required documentation. The following provides important dates for payroll to ensure paychecks are processed on time. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous.

The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. The following provides important dates for payroll to ensure paychecks are processed on time. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. This page provides important payroll information for new and current employees, including required documentation.

The following provides important dates for payroll to ensure paychecks are processed on time. This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as.

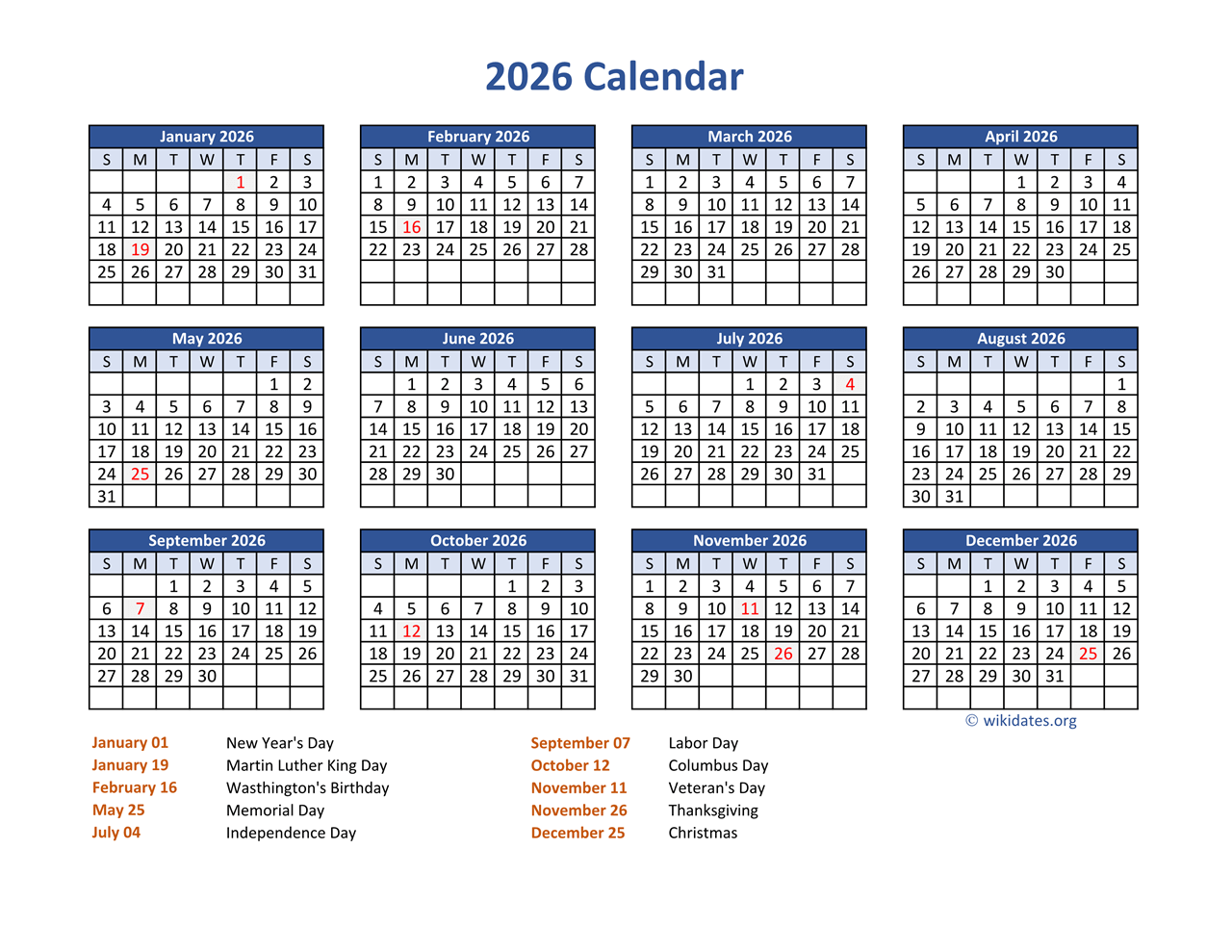

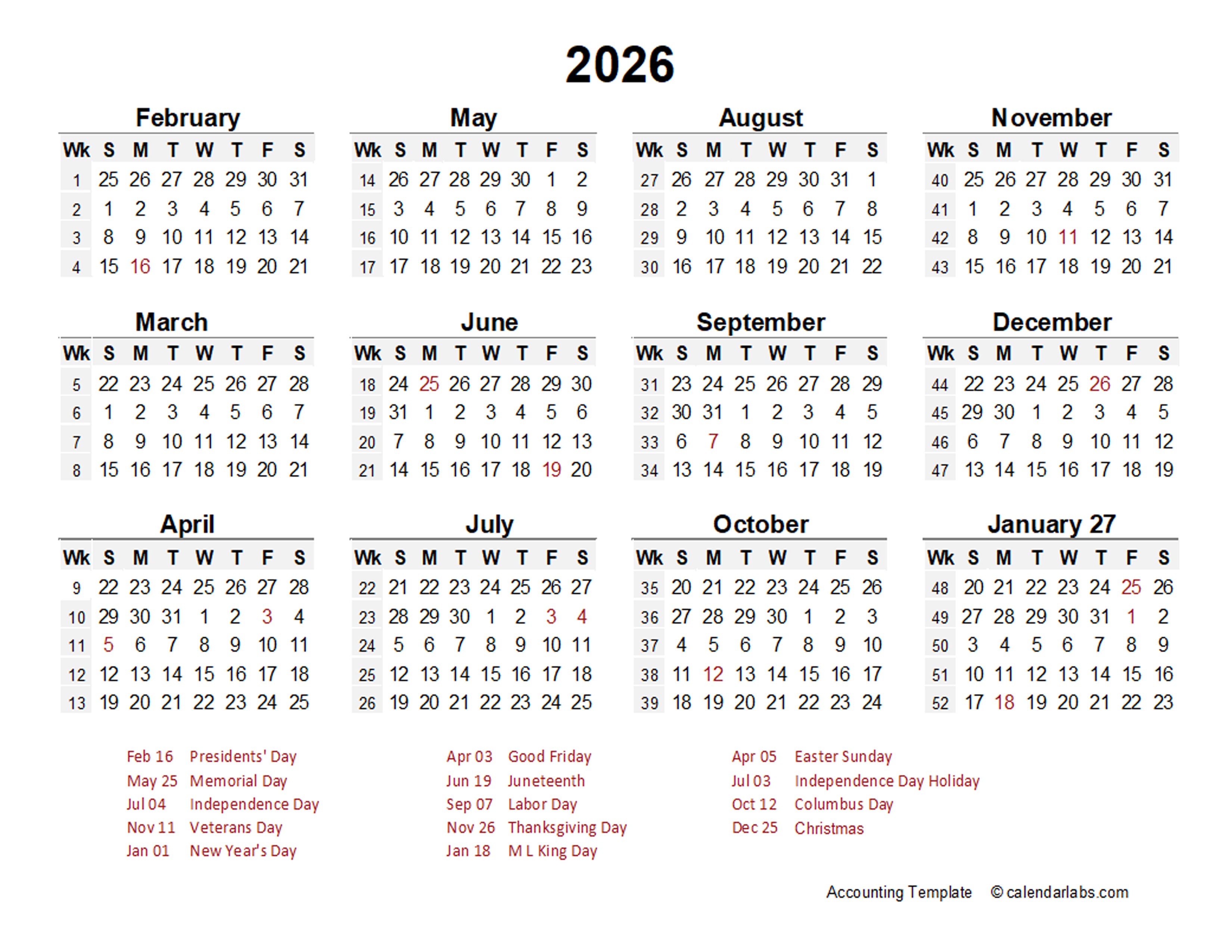

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive

The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. The following provides important dates for payroll to ensure paychecks.

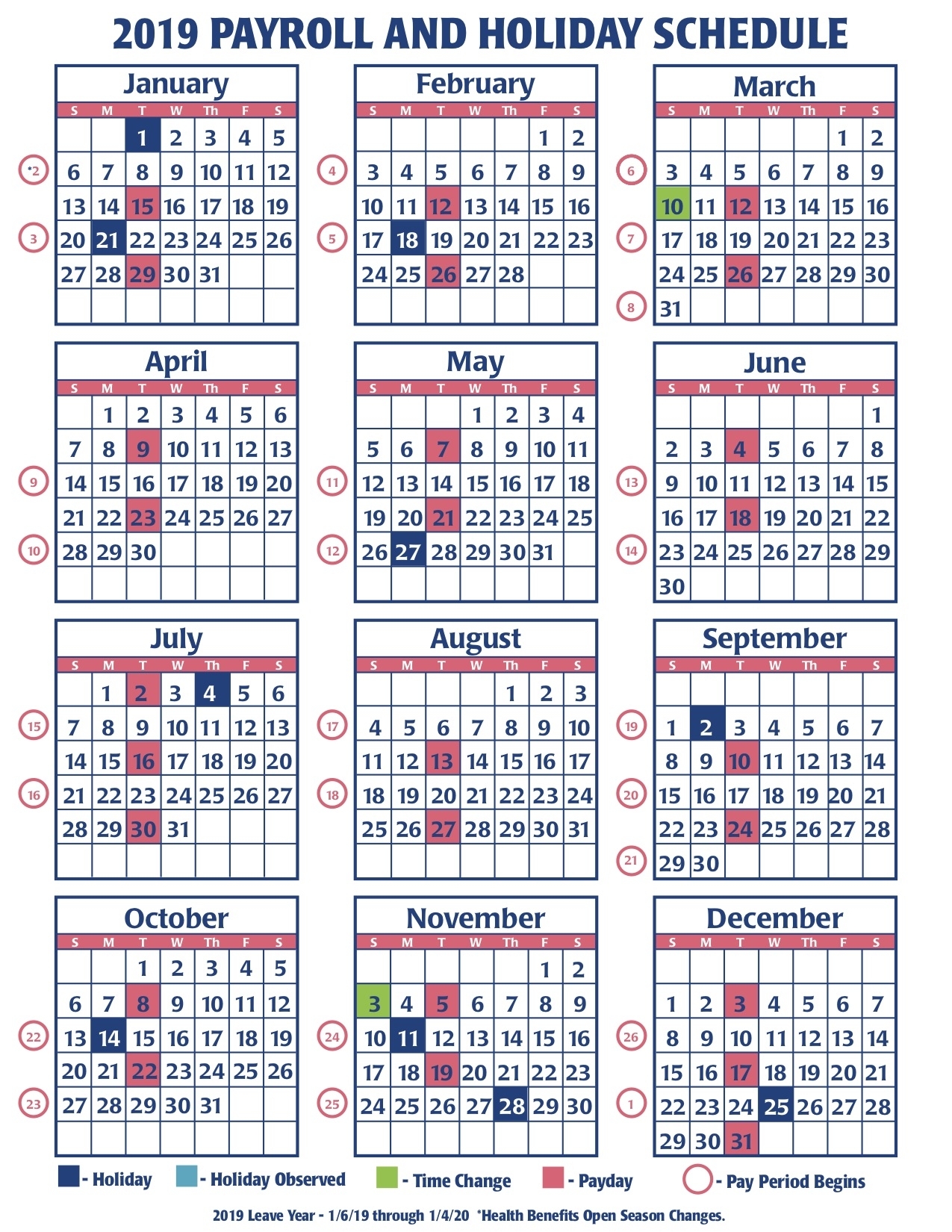

Navigating The Federal Pay Calendar A Comprehensive Guide To

The following provides important dates for payroll to ensure paychecks are processed on time. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. This page provides important payroll information for new and current employees, including required documentation. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the.

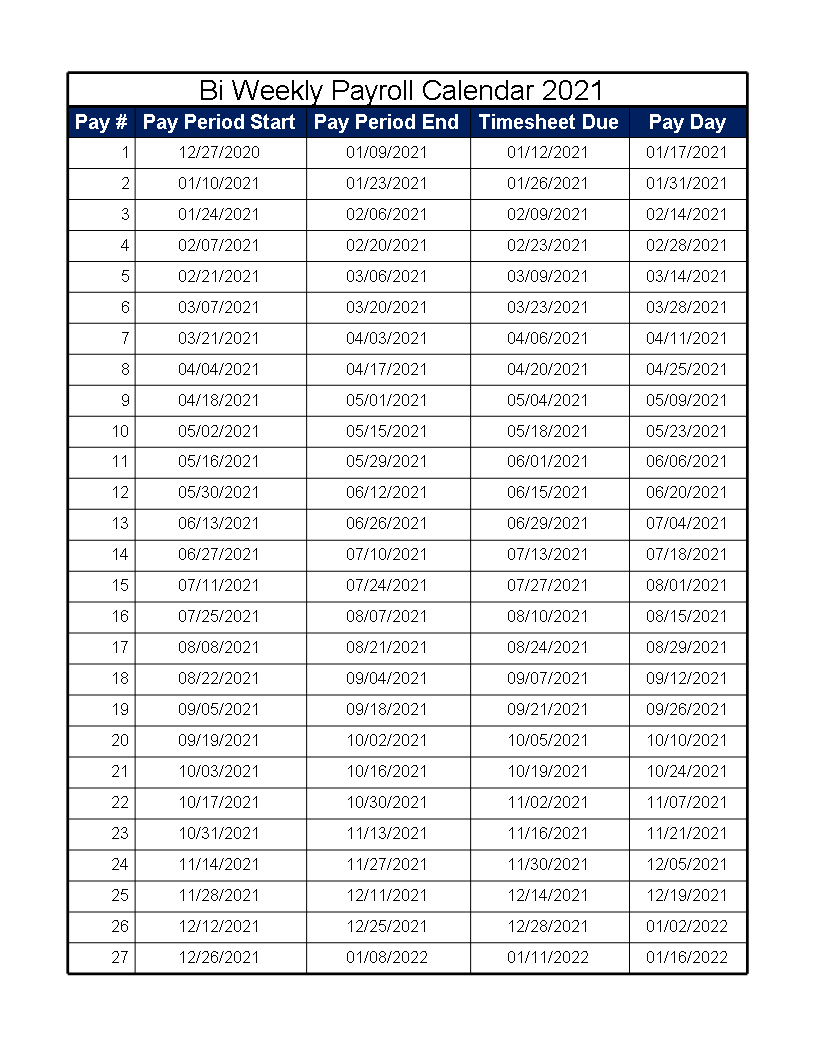

2026 Bi Weekly Payroll Calendar Free Printable Calendar

This page provides important payroll information for new and current employees, including required documentation. The following provides important dates for payroll to ensure paychecks are processed on time. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

Siue 2025 2026 Calendar Tilde M. Paulsen

The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. This page provides important payroll information for new and current employees, including required documentation. The following provides important dates for payroll to ensure paychecks.

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive

The following provides important dates for payroll to ensure paychecks are processed on time. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

2025 2026 Calendar Stanford Gavin Rivera

The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. The following provides important dates for payroll to ensure paychecks.

2026 payroll calendar GSA

The following provides important dates for payroll to ensure paychecks are processed on time. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

Navigating The Federal Pay Calendar For 2026 A Comprehensive Guide

The following provides important dates for payroll to ensure paychecks are processed on time. This page provides important payroll information for new and current employees, including required documentation. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

Payroll Calendars Henrico HR

The following provides important dates for payroll to ensure paychecks are processed on time. This page provides important payroll information for new and current employees, including required documentation. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

Printable Payroll Calendars

This page provides important payroll information for new and current employees, including required documentation. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as. The following provides important dates for payroll to ensure paychecks are processed on time. Taxable earnings include regular pay, overtime pay, supplementary compensation, and.

The Following Provides Important Dates For Payroll To Ensure Paychecks Are Processed On Time.

This page provides important payroll information for new and current employees, including required documentation. Taxable earnings include regular pay, overtime pay, supplementary compensation, and any additional and miscellaneous. The 2025/2026 winter close will be from monday, december 22, 2025, through friday, january 2, 2026, with the following dates designated as.