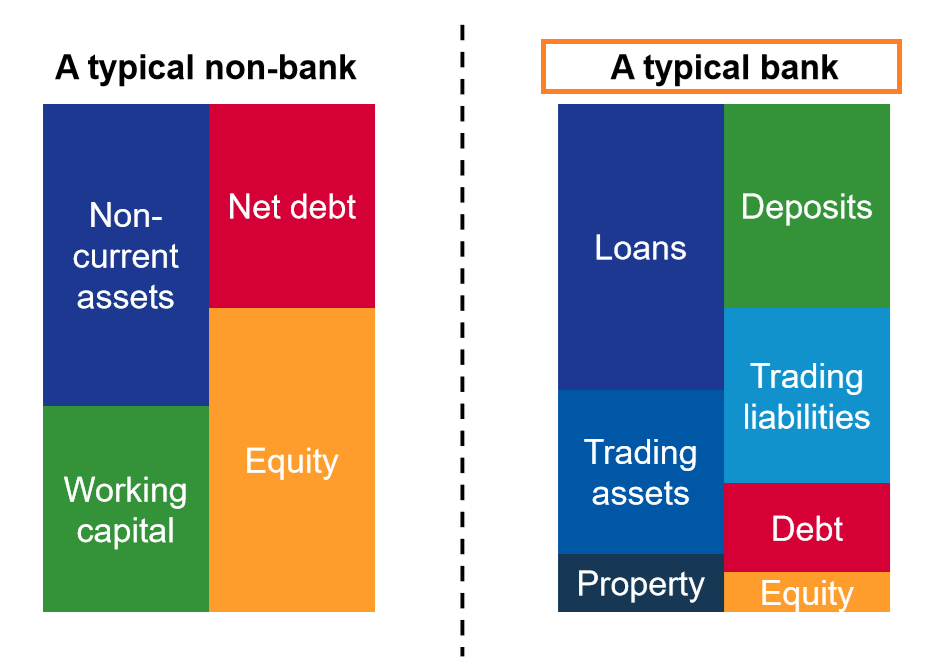

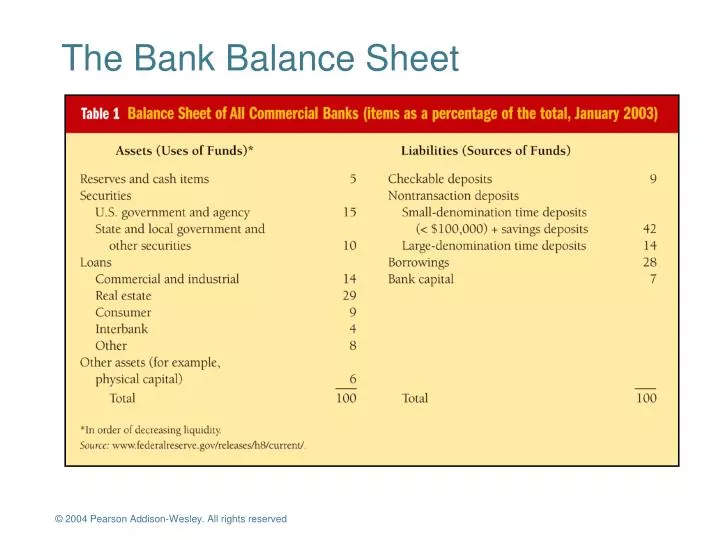

Sheet Bank - Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. It consists of assets, representing what the bank owns, and. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. A bank's balance sheet provides a snapshot of its financial position at a specific time.

Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank's balance sheet provides a snapshot of its financial position at a specific time. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. It consists of assets, representing what the bank owns, and.

Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank's balance sheet provides a snapshot of its financial position at a specific time. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. It consists of assets, representing what the bank owns, and.

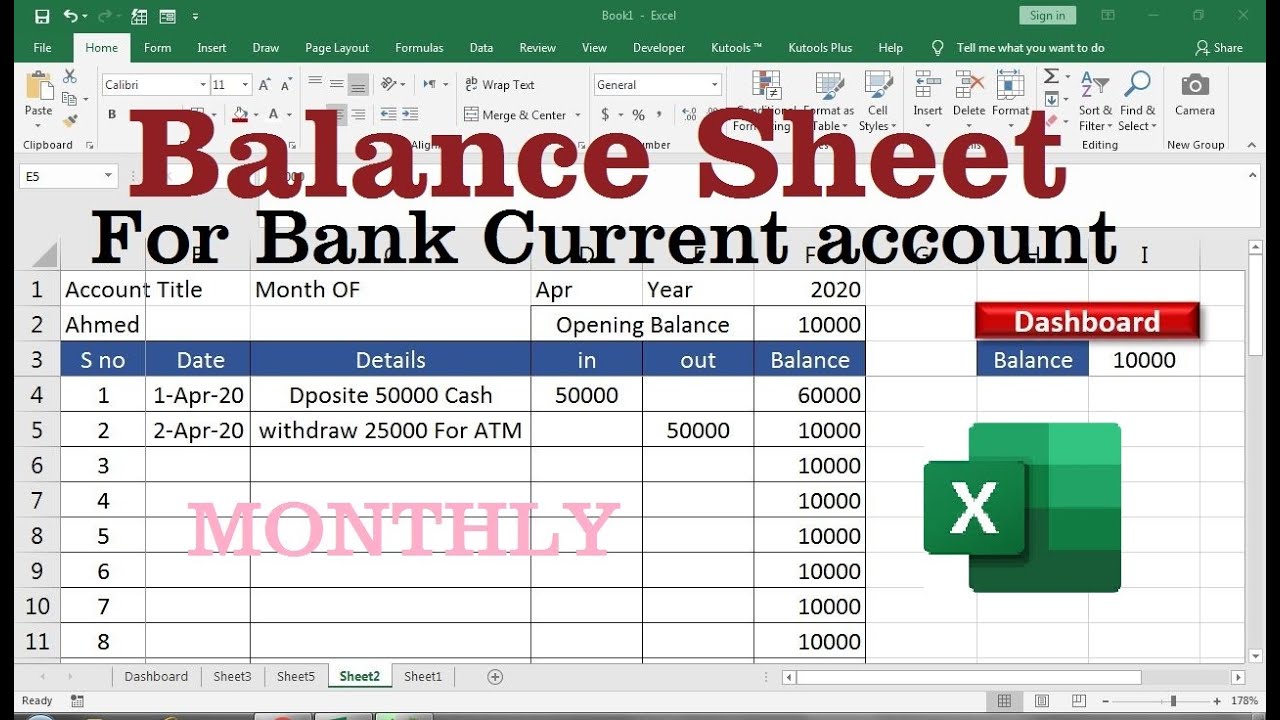

bank balance sheet explanation YouTube

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the..

How Does A Bank S Balance Sheet Work at Ruth Sapp blog

Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s..

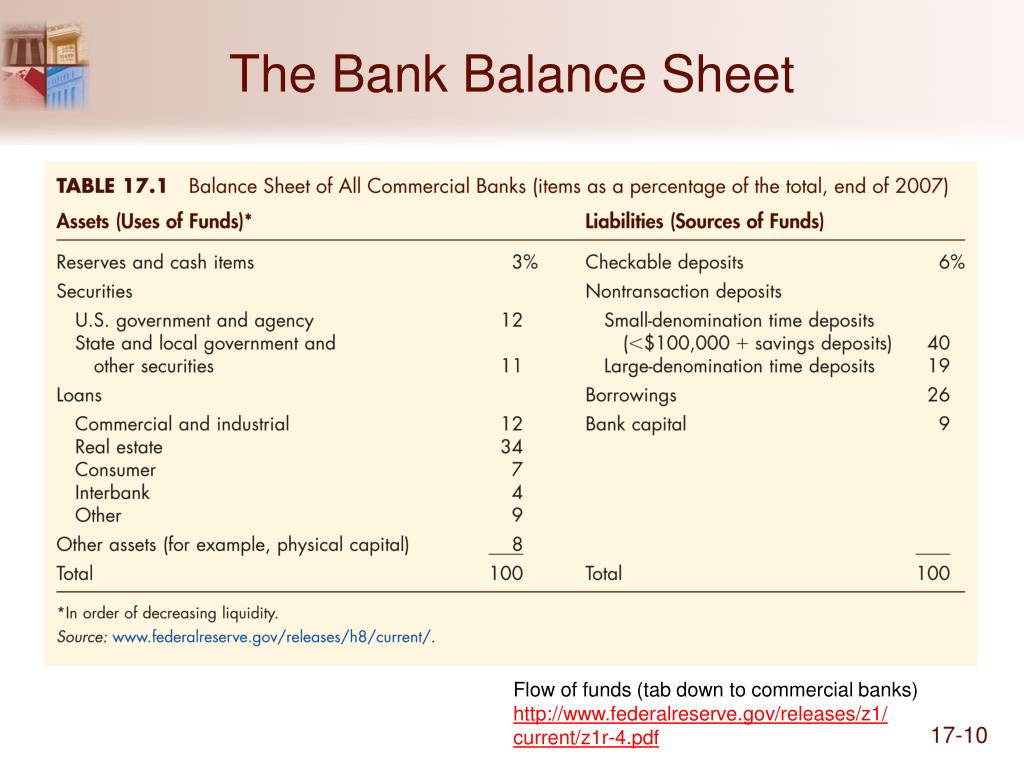

PPT The Bank Balance Sheet PowerPoint Presentation, free download

Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. It consists of assets, representing what the bank owns, and. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Relationship balances include owned consumer checking, savings, money market,.

[Economics] What is Understanding Balance sheet of a Commercial Bank

A bank's balance sheet provides a snapshot of its financial position at a specific time. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Bank balance sheets are an accounting of.

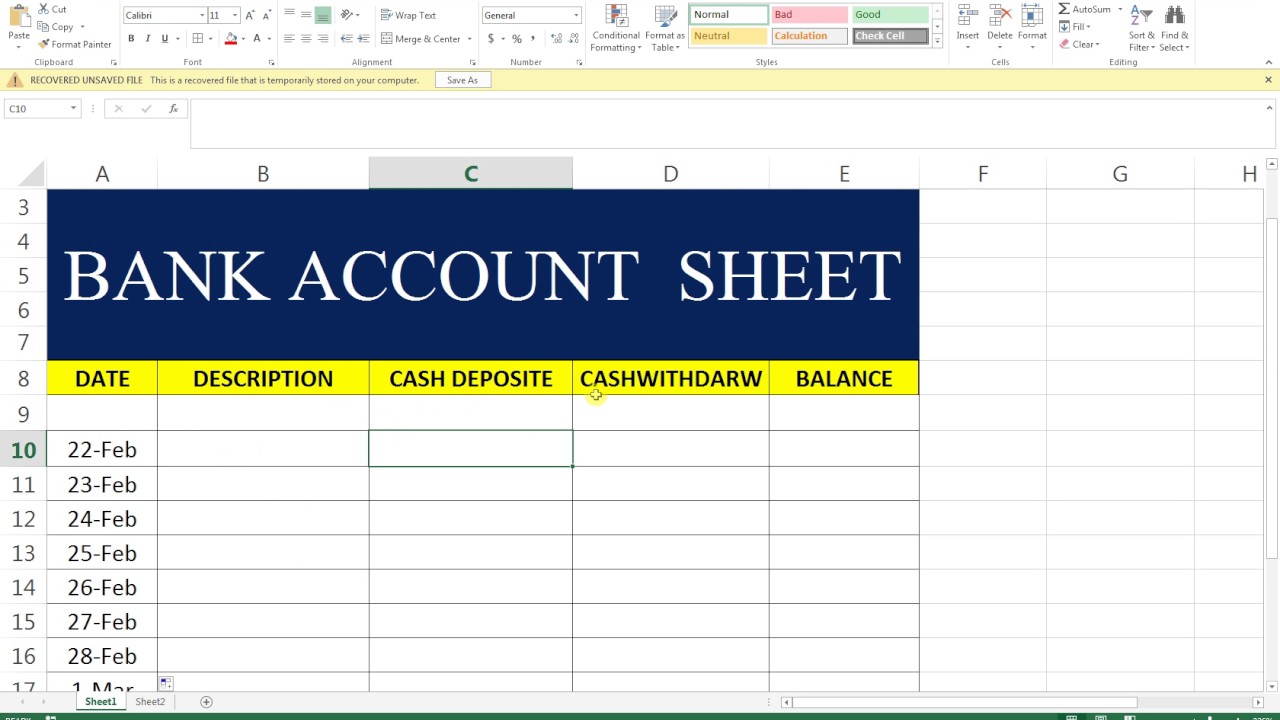

EXCEL BASIC SHEET 4 BANK ACCOUNT SHEET YouTube

A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to.

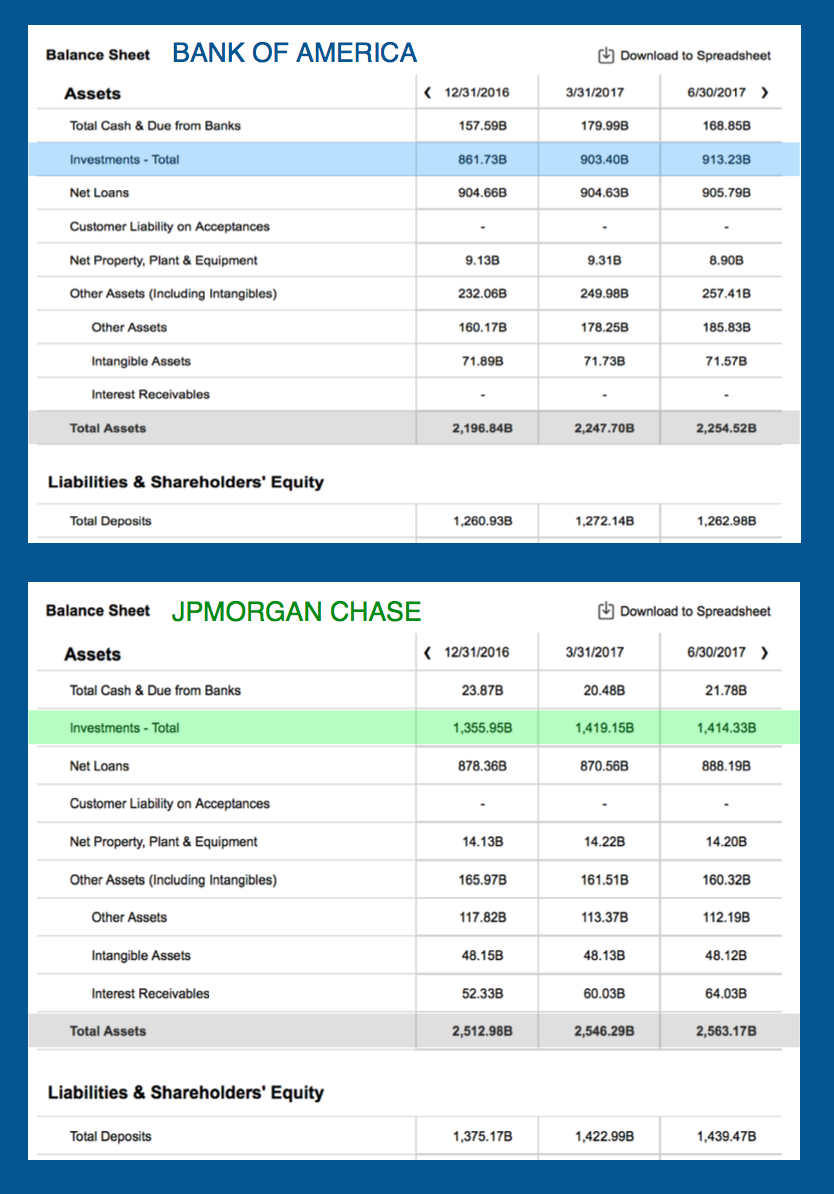

How Bank Of America And Chase Use Their Balance Sheets

A bank's balance sheet provides a snapshot of its financial position at a specific time. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Instead, several unique.

Free printable money balance sheet, Download Free printable money

Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. A bank’s balance.

Bank Statement Administrative Report Management Excel Template And

A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest.

Banks Balance Sheet Complete Guide on Banks Balance Sheet

Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning..

PPT Chapter 17 PowerPoint Presentation ID74190

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. A bank's balance sheet provides a snapshot of its financial position at a specific time. A bank balance sheet.

A Bank Balance Sheet Is A Key Way To Draw Conclusions Regarding A Bank’s Business And The Resources Used To Be Able To Finance Lending.

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. It consists of assets, representing what the bank owns, and. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors.

A Bank's Balance Sheet Provides A Snapshot Of Its Financial Position At A Specific Time.

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the.

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)