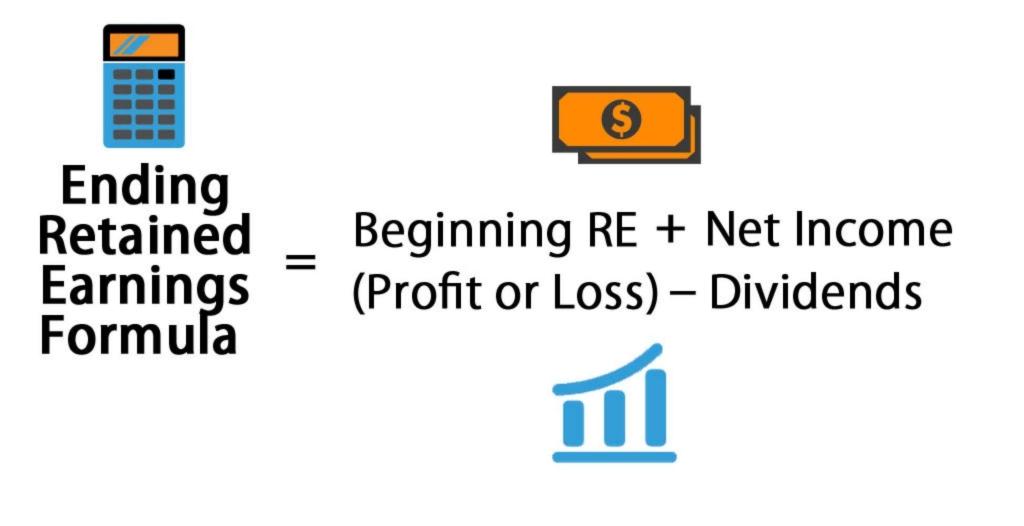

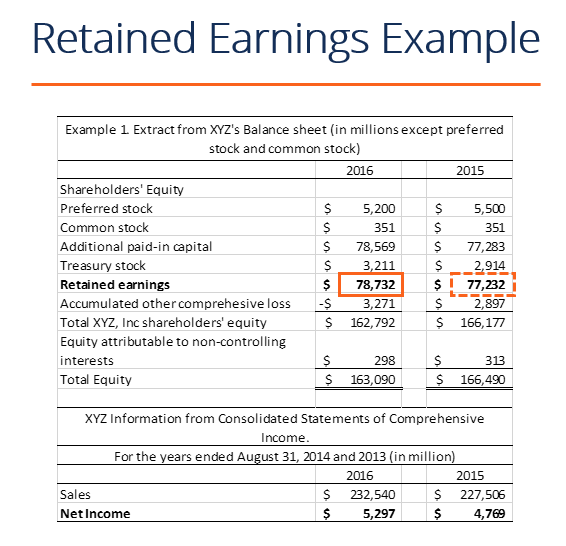

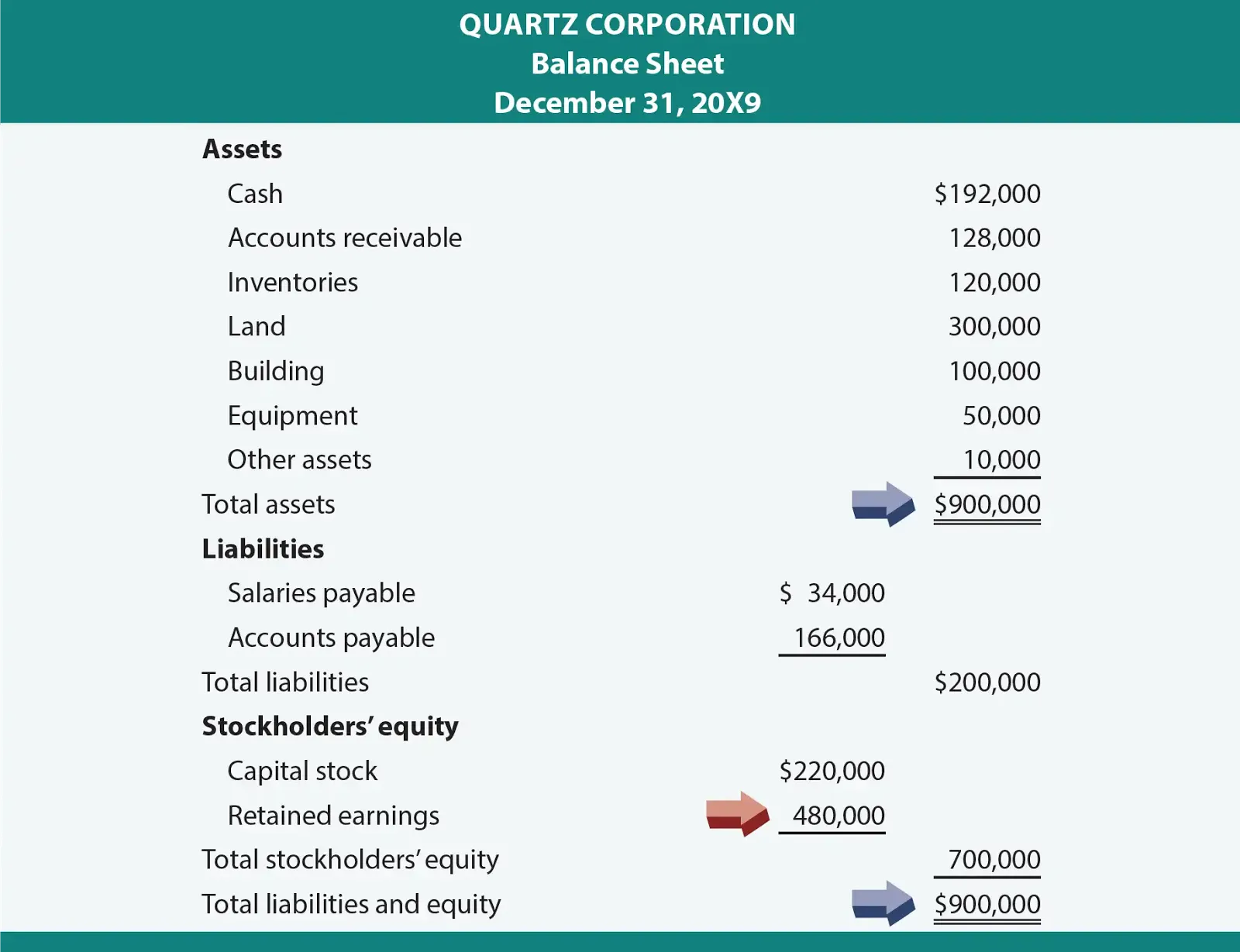

Retained Earnings Formula Balance Sheet - At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. As an important concept in accounting, the word “retained” captures. Your accounting software will handle this calculation for you when it. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. How to calculate retained earnings. The steps to calculate retained earnings on the balance sheet for the current period are as follows. The retained earnings formula is fairly straightforward: Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments.

The steps to calculate retained earnings on the balance sheet for the current period are as follows. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. As an important concept in accounting, the word “retained” captures. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. Your accounting software will handle this calculation for you when it. This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. The retained earnings formula is fairly straightforward: How to calculate retained earnings.

The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. As an important concept in accounting, the word “retained” captures. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings formula is fairly straightforward: This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. The steps to calculate retained earnings on the balance sheet for the current period are as follows. How to calculate retained earnings.

Retained Earnings Definition, Formula, and Example

The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. This is the cumulative incomes from the current year’s earnings.

What are Retained Earnings? Guide, Formula, and Examples

This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. Your accounting software will handle this calculation for you when it. To calculate re, the beginning re balance is added to the net income or.

Retained Earnings Explained Definition, Formula, & Examples

This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. The retained earnings formula is fairly straightforward: Retained earnings are the cumulative net earnings or profits of a company after accounting for.

Balance Sheet and Statement of Retained Earnings YouTube

The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. Your accounting software will handle this calculation for you when it. This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. The retained earnings formula is fairly straightforward: As an important concept.

Retained Earnings on the Balance Sheet Overview Business Accounting

Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. The steps to calculate retained earnings on the balance sheet for the current period are as follows. Your accounting software will handle this calculation for.

Retained Earnings What Are They, and How Do You Calculate Them?

The retained earnings formula is fairly straightforward: Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. As an important concept in accounting, the word “retained” captures. This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. How to calculate.

What are Retained Earnings? Guide, Formula, and Examples

The retained earnings formula is fairly straightforward: At the end of every accounting cycle, you’ll see retained earnings on the balance sheet. As an important concept in accounting, the word “retained” captures. How to calculate retained earnings. This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to.

Looking Good Retained Earnings Formula In Balance Sheet Difference

The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. Your accounting software will handle this calculation for you when it. The steps to calculate retained earnings on the balance sheet for the current period are as follows. At the end of every accounting cycle, you’ll see retained earnings on the balance.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. The retained earnings formula is fairly straightforward: Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Your accounting software will handle this calculation for you when it. At the end of every.

What Is the Normal Balance of Retained Earnings

As an important concept in accounting, the word “retained” captures. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. How to calculate retained earnings. The retained earnings formula is fairly straightforward: To calculate re, the beginning re balance is added to the net income or reduced by a net loss and.

To Calculate Re, The Beginning Re Balance Is Added To The Net Income Or Reduced By A Net Loss And Then.

This is the cumulative incomes from the current year’s earnings and the previous years, save for any dividends distributed to. Your accounting software will handle this calculation for you when it. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net. How to calculate retained earnings.

Retained Earnings Are The Cumulative Net Earnings Or Profits Of A Company After Accounting For Dividend Payments.

As an important concept in accounting, the word “retained” captures. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings formula is fairly straightforward: At the end of every accounting cycle, you’ll see retained earnings on the balance sheet.