Private Equity Term Sheet - The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. Term sheets are often associated. Term sheets are used for mergers, acquisitions, and commercial real estate development. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity.

Term sheets are used for mergers, acquisitions, and commercial real estate development. This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. Term sheets are often associated. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private.

Term sheets are used for mergers, acquisitions, and commercial real estate development. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. Term sheets are often associated. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding.

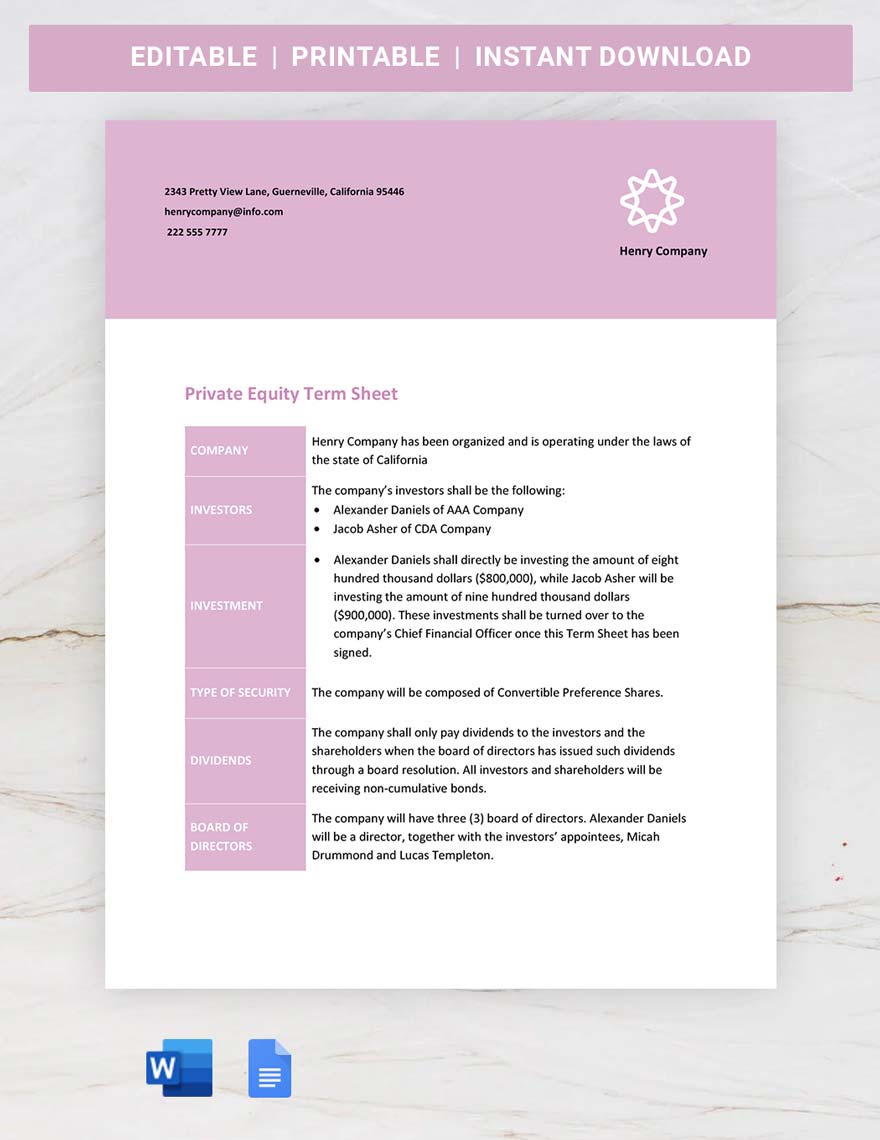

Free Private Equity Term Sheet Template to Edit Online

Term sheets are used for mergers, acquisitions, and commercial real estate development. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. This term sheet summarizes the principal terms.

Equity Term Sheet Template

Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make.

Private Equity Deal Sheet Template

A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Term sheets are used for mergers, acquisitions, and commercial real estate development. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital.

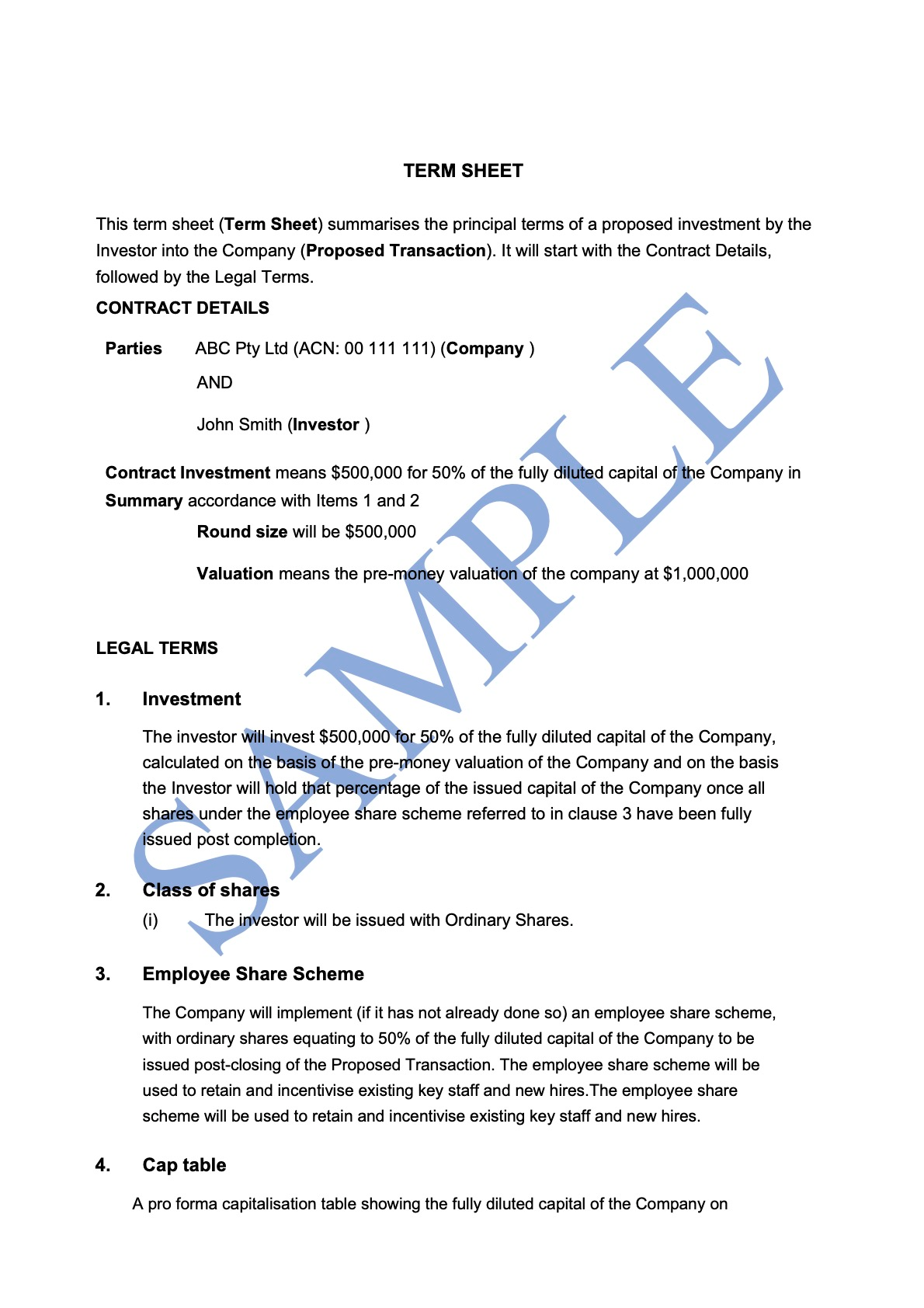

Term Sheet Investment Free Template Sample Lawpath

A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Term sheets are often associated. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. Term sheets are used for mergers, acquisitions, and commercial real estate development. The term.

Private Equity Term Sheet Template

A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Term sheets are often associated. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. This term sheet summarizes.

A guide to Series A term sheet parameters, template and how to create

This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. Term sheets are often associated. Private equity term sheets serve as the blueprint.

How to Get Venture Capital Funding in 10 Steps

Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Term sheets are often associated. Term sheets are used for mergers, acquisitions, and commercial real estate development. This term.

Advanced Private Equity Term Sheets and Series A Documents Business

The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Term sheets are often associated. Private equity term sheets.

Free Printable Term Sheet Templates [Word, Excel, PDF] Investment

Term sheets are used for mergers, acquisitions, and commercial real estate development. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. A summary of terms (often called.

Private Equity Fund Term Sheet Template

A summary of terms (often called a term sheet) like the one described below, should be created and agreed to before you make an equity. Private equity term sheets serve as the blueprint for significant financial transactions, encapsulating the preliminary understanding. Term sheets are used for mergers, acquisitions, and commercial real estate development. The term sheet is the first step.

A Summary Of Terms (Often Called A Term Sheet) Like The One Described Below, Should Be Created And Agreed To Before You Make An Equity.

This term sheet summarizes the principal terms with respect to a potential private placement of equity securities of (the “company”) by. The term sheet is the first step in the process leading to definitive agreements that will reflect the terms of the venture capital or other private. Term sheets are often associated. Term sheets are used for mergers, acquisitions, and commercial real estate development.

![Free Printable Term Sheet Templates [Word, Excel, PDF] Investment](https://www.typecalendar.com/wp-content/uploads/2023/05/investment-term-sheet.jpg)