De 4 Tax Form - Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding.

The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this.

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in.

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld.

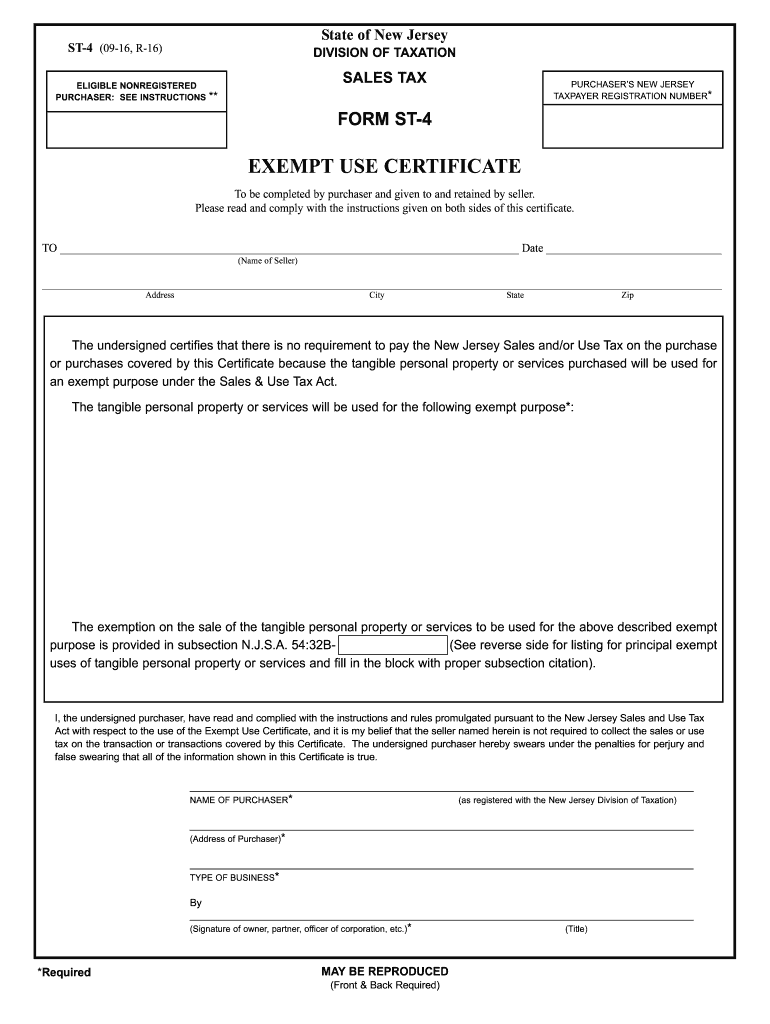

20162024 Form NJ ST4 Fill Online, Printable, Fillable, Blank pdfFiller

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be.

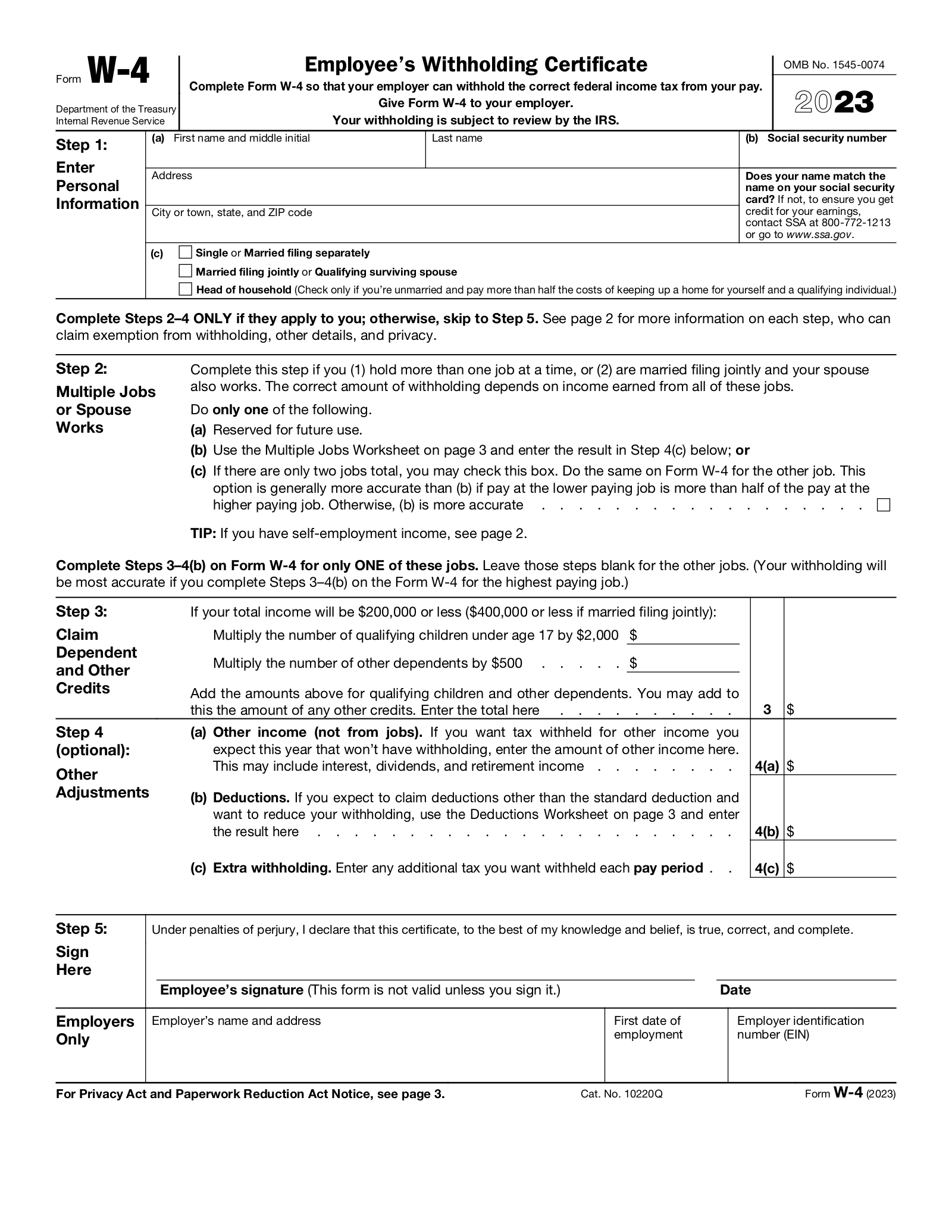

Is There A New W4 Form For 2024 Anny Malina

The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. Filling out the california withholding form de 4 is.

IRS Tax Forms eForms

For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is.

Tax Form 2024 Pdf Download Joya Rubina

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding.

Irs Form W4 2024 Olga Tiffie

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be.

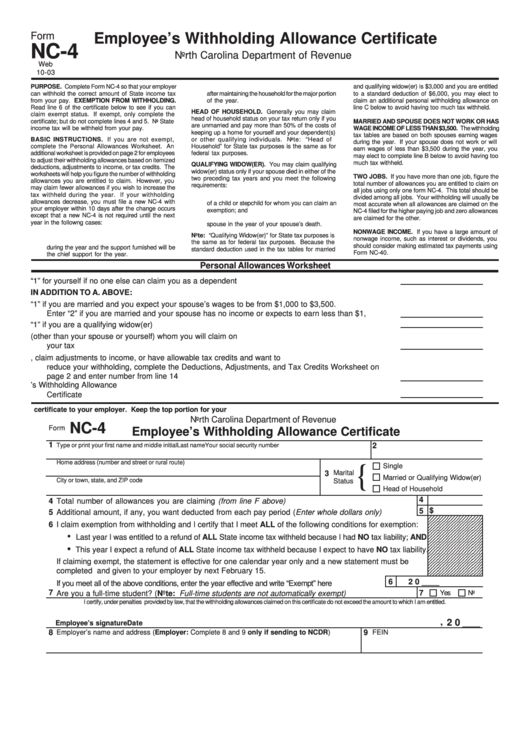

Form Nc 4 2003 Employee S Withholding Allowance Certificate Printable

For state withholding, use the worksheets on this. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. The de 4 is used to compute the amount of taxes to be.

W4 Form 2025 Withholding Adjustment W4 Forms TaxUni

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. Filling out the california withholding form de 4 is.

Everything you need to know about the new W4 tax form Good Morning

For state withholding, use the worksheets on this. The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is.

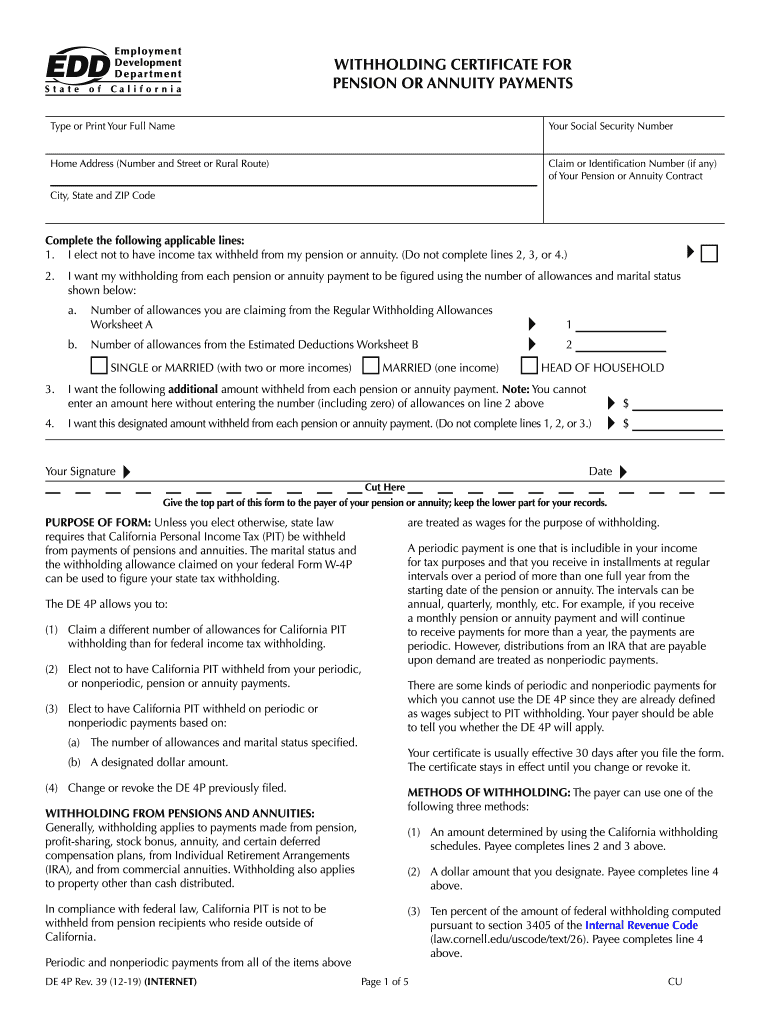

CA EDD DE 4P 20192022 Fill and Sign Printable Template Online US

The de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding. De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this. Filling out the california withholding form de 4 is.

The De 4 Is Used To Compute The Amount Of Taxes To Be Withheld From Your Wages, By Your Employer, To Accurately Reflect Your State Tax Withholding.

De 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. For state withholding, use the worksheets on this.