City Of Portland Tax Forms - Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online or by mail. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Printable forms for previous tax years for the portland business license tax (including rrr, hvt, and ces), multnomah county business. Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information.

Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Printable forms for previous tax years for the portland business license tax (including rrr, hvt, and ces), multnomah county business. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online or by mail. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies.

Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online or by mail. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Printable forms for previous tax years for the portland business license tax (including rrr, hvt, and ces), multnomah county business. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies.

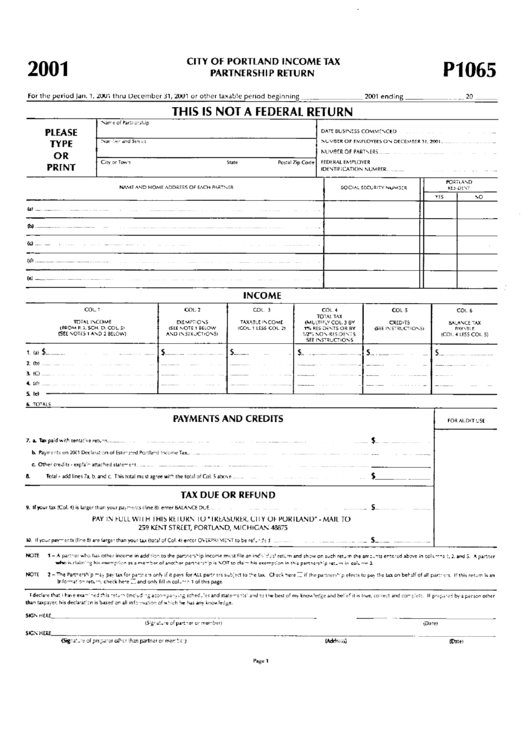

Form P1065 City Of Portland Tax Partnership Return 2001

Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online.

Portland property owners brace for new tax bills after revaluation

The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. The city of portland/multnomah county business tax return.

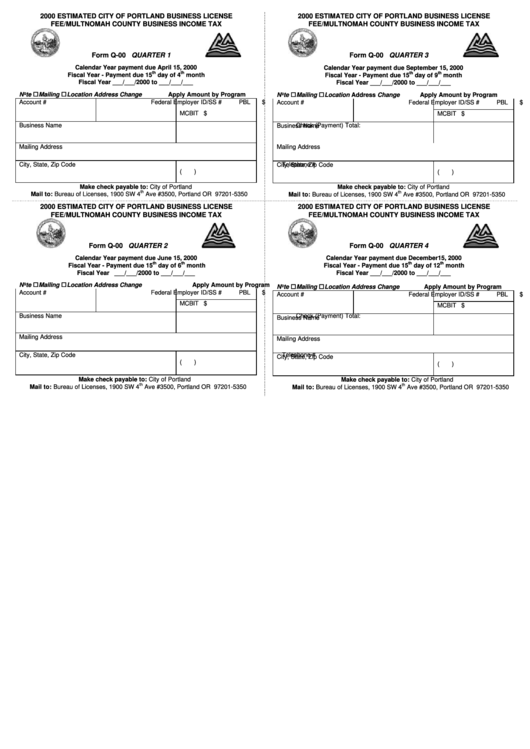

Form Q00 Estimated City Of Portland Business License Fee/multnomah

Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the portland business license tax (including rrr, hvt, and ces), multnomah county business. The.

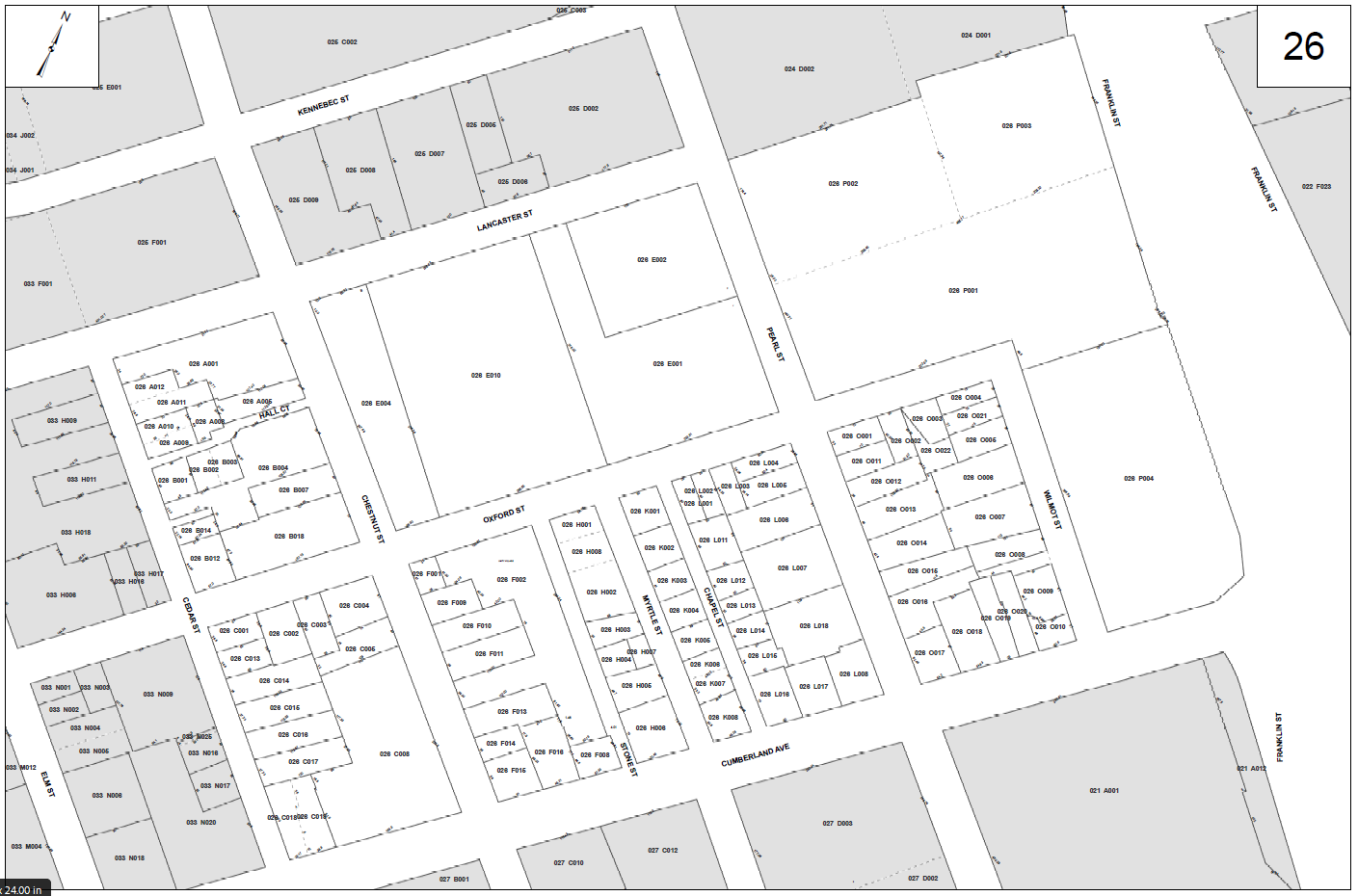

Portland, ME Tax Map Creation CAI Technologies

The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the.

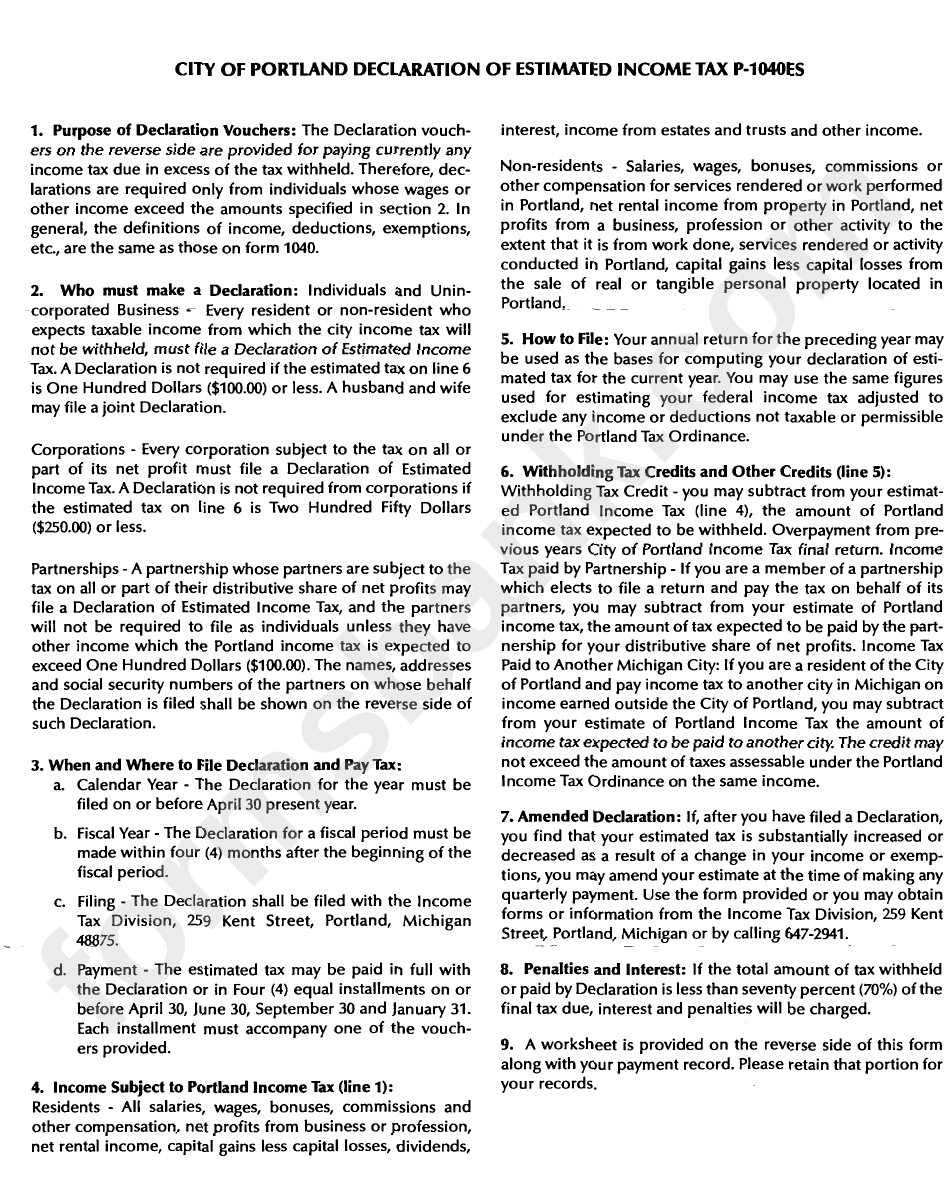

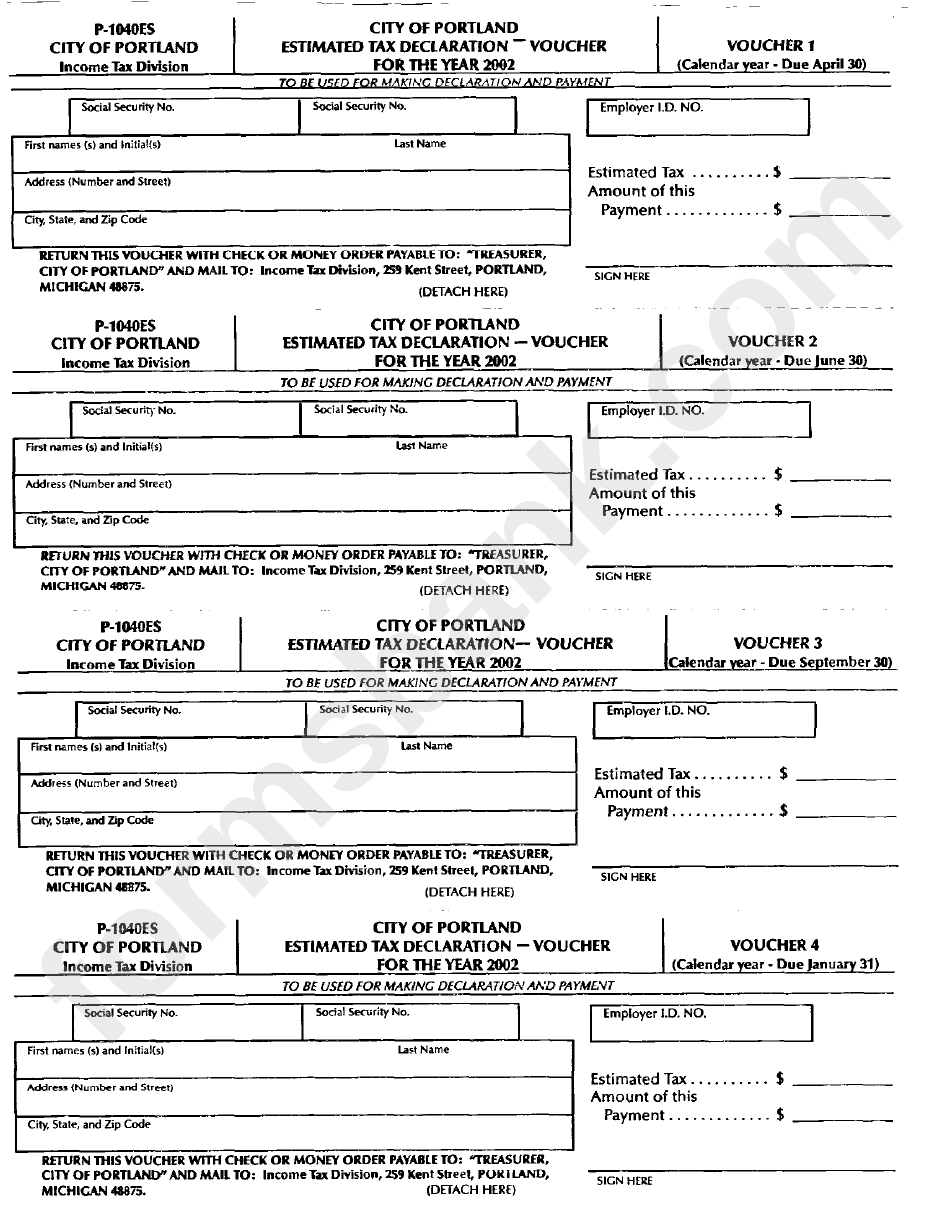

City Of Portland Declaration Of Estimated Tax P1040es

The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. The city of portland/multnomah county business tax return.

City of Portland (the original one) (cityportland) • Threads, Say more

Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online or by mail..

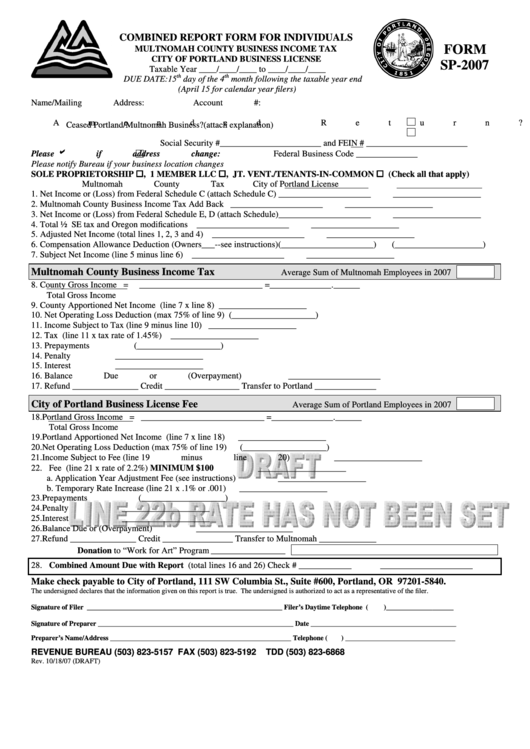

Form Sp2007 Draft Combined Report Form For Individuals Multnomah

The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. The city of portland/multnomah county business tax return is due april 15 for calendar year taxpayers and may be filed online or by mail. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable.

Portland oregon park bridge Stock Vector Images Alamy

Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the portland business license tax (including rrr, hvt, and ces), multnomah county business. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Printable forms for previous tax.

Tax Forms Portland, MI Official Website

Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the.

Form P1040es City Of Portland Estimated Tax Declaration Voucher For

Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the.

The City Of Portland/Multnomah County Business Tax Return Is Due April 15 For Calendar Year Taxpayers And May Be Filed Online Or By Mail.

Compliance with federal form 1099 filing requirements and comparison of arts tax filings to federal taxfiler information. Portland revenue online (pro) is the revenue division's secure portal where taxpayers can register for a business tax account (including. Printable forms for previous tax years for the metro supportive housing services (shs) personal income tax and multnomah county. The following provides information pertinent to tax filers, tax professionals, employers and payroll software companies.