A Firm Should Accept Independent Projects If - Produces a net present value that is greater. For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When the firm is considering independent projects, if the projects npv exceeds zero the firm. The payback is less than the irr. The firm should accept independent projects if: There are several criteria that a. When should a company accept independent projects? It can be used as a rough screening device to eliminate those projects whose returns do not. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. An independent project should be accepted if it:

When the firm is considering independent projects, if the projects npv exceeds zero the firm. The payback is less than the irr. There are several criteria that a. The firm should accept independent projects if: For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When should a company accept independent projects? Produces a net present value that is greater. If npv is greater than $0, accept the project. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. It can be used as a rough screening device to eliminate those projects whose returns do not.

The payback is less than the irr. Produces a net present value that is greater. When should a company accept independent projects? If npv is greater than $0, accept the project. For mutually exclusive projects, the net present value (npv) is usually preferred over methods. It can be used as a rough screening device to eliminate those projects whose returns do not. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. There are several criteria that a. The firm should accept independent projects if: When the firm is considering independent projects, if the projects npv exceeds zero the firm.

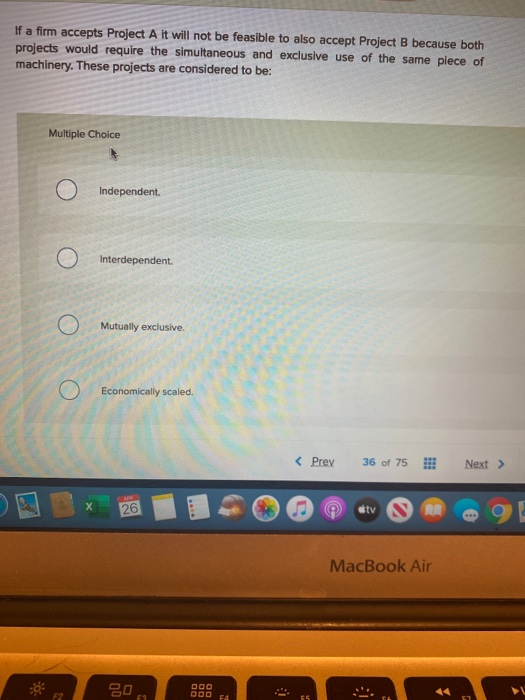

Solved If a firm accepts Project A it will not be feasible

Produces a net present value that is greater. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. If npv is greater than $0, accept the project. There are several criteria that a. An independent project should be accepted if it:

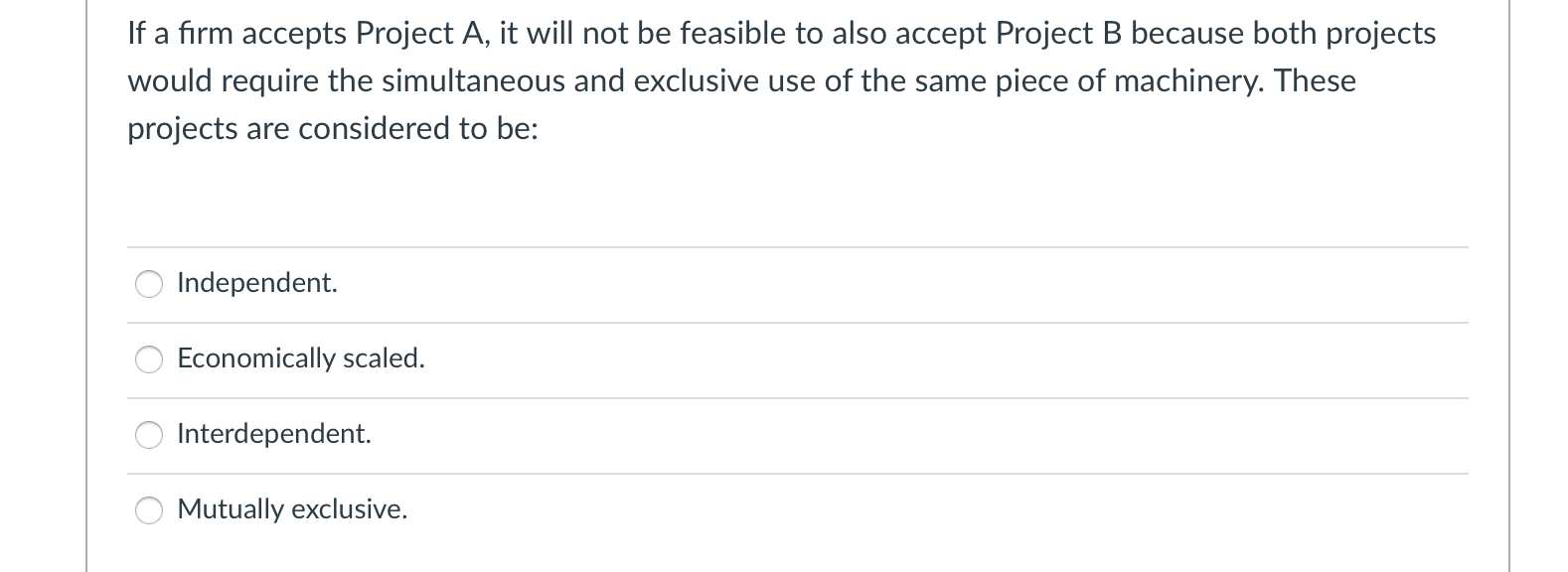

Solved If a firm accepts Project A, it will not be feasible

There are several criteria that a. For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When should a company accept independent projects? It can be used as a rough screening device to eliminate those projects whose returns do not. The payback is less than the irr.

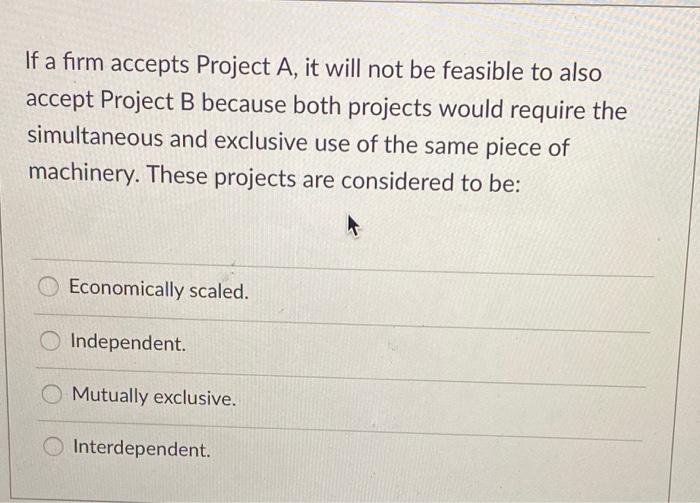

Solved If a firm accepts Project A, it will not be feasible

An independent project should be accepted if it: There are several criteria that a. If npv is greater than $0, accept the project. The payback is less than the irr. Produces a net present value that is greater.

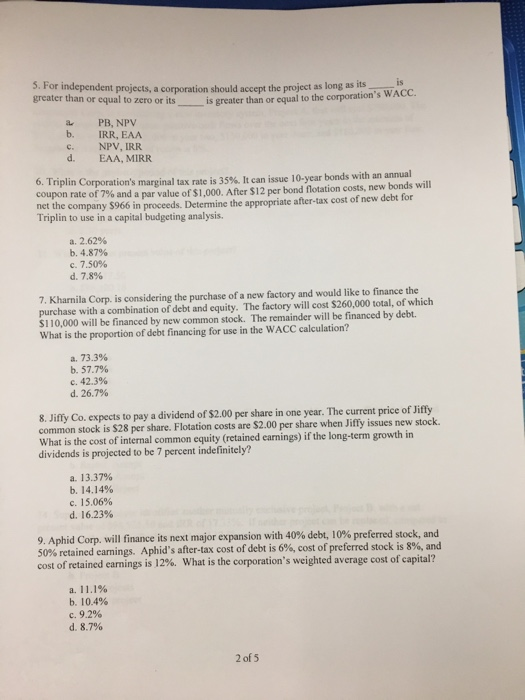

Solved 5. For independent projects, a corporation should

When the firm is considering independent projects, if the projects npv exceeds zero the firm. It can be used as a rough screening device to eliminate those projects whose returns do not. There are several criteria that a. The firm should accept independent projects if: The payback is less than the irr.

Solved If this is an independent project, the IRR method

An independent project should be accepted if it: A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. Produces a net present value that is greater. There are several criteria that a. For mutually exclusive projects, the net present value (npv) is usually preferred over methods.

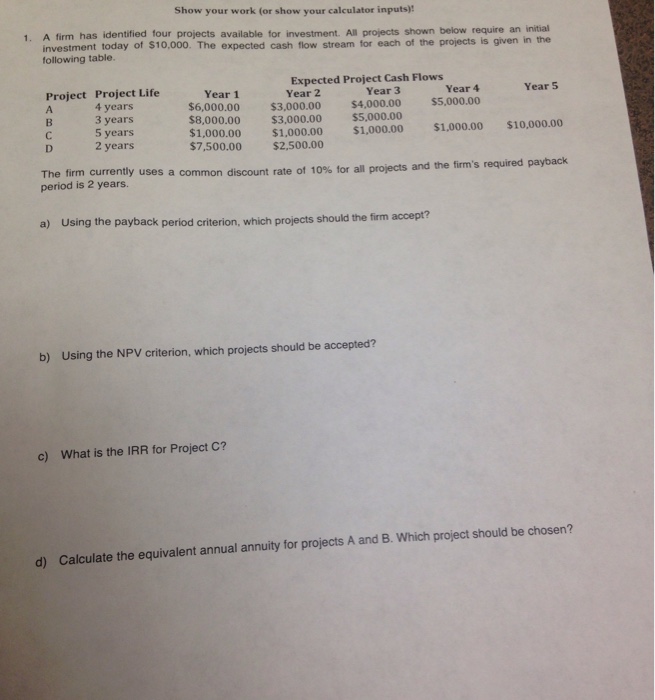

Solved A firm has identified four projects available for

When should a company accept independent projects? A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. If npv is greater than $0, accept the project. For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When the firm is considering independent projects, if the projects npv exceeds.

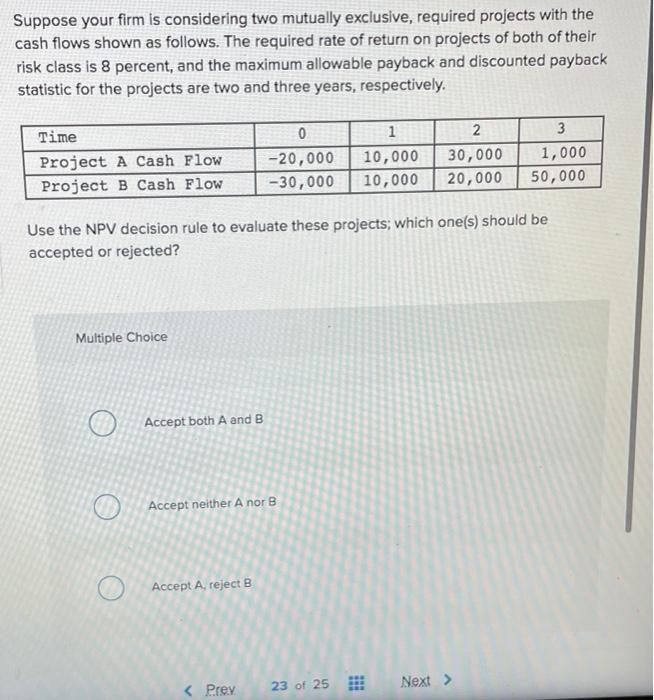

Solved Suppose your firm is considering two independent

An independent project should be accepted if it: The payback is less than the irr. The firm should accept independent projects if: Produces a net present value that is greater. When the firm is considering independent projects, if the projects npv exceeds zero the firm.

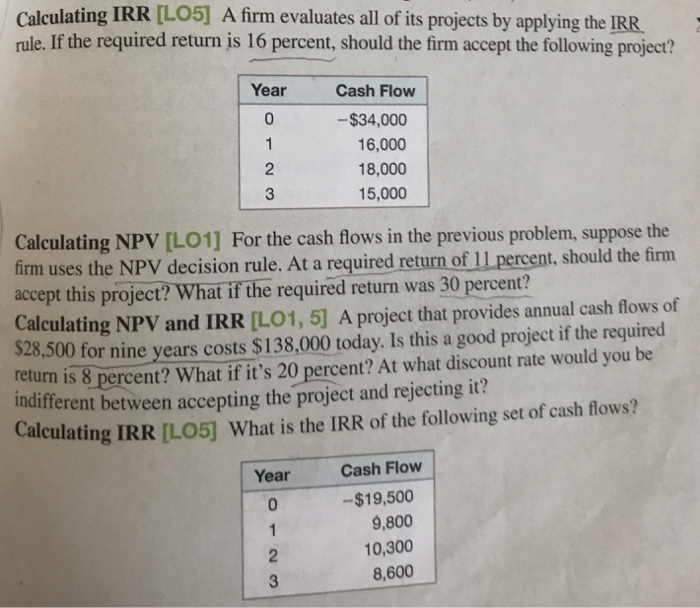

Solved A firm evaluates all of its projects by applying the

The firm should accept independent projects if: An independent project should be accepted if it: Produces a net present value that is greater. The payback is less than the irr. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the.

Solved a. Distinguish between independent projects and

For mutually exclusive projects, the net present value (npv) is usually preferred over methods. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. An independent project should be accepted if it: When the firm is considering independent projects, if the projects npv exceeds zero the firm. If npv is greater than.

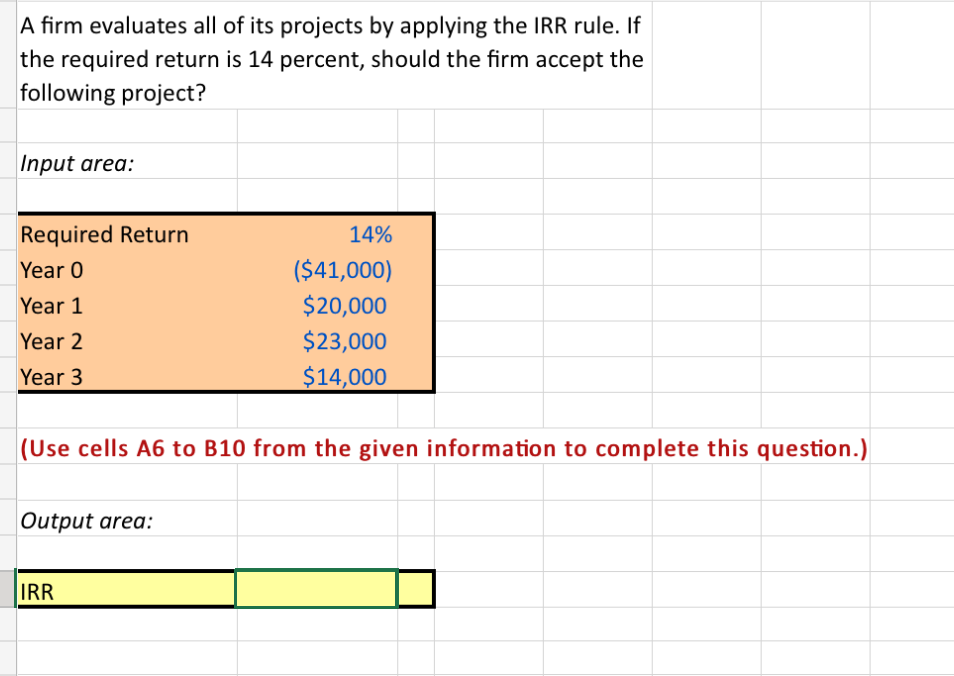

Solved A firm evaluates all of its projects by applying the

A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. The firm should accept independent projects if: For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When the firm is considering independent projects, if the projects npv exceeds zero the firm. Produces a net present value that.

An Independent Project Should Be Accepted If It:

There are several criteria that a. When the firm is considering independent projects, if the projects npv exceeds zero the firm. It can be used as a rough screening device to eliminate those projects whose returns do not. The firm should accept independent projects if:

If Npv Is Greater Than $0, Accept The Project.

A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the. For mutually exclusive projects, the net present value (npv) is usually preferred over methods. When should a company accept independent projects? Produces a net present value that is greater.